What genres should hyper-casual game developers pay attention to at the end of 2022

After growing during the pandemic, the mobile games market was in anticipation of a stagnation period, but now some analysts predict the market will fall by more than 6% by the end of the year. Given the increased competition and player demands, this makes user acquisition even more difficult.

The approach based on pumping the market full of a large number of raw prototypes is no longer effective — even major publishers have begun choosing genres more carefully. This fact is especially resonant among small or independent developers that don’t have a large safety buffer.

Analyzing the market’s dynamics by genre doesn’t guarantee the success of a new release but it’ll certainly help increase its chances. To start things off, we’ll first take a look at the situation with competition in general, and then move on to individual genres that are popular with players in 2022 and what the developers are releasing in response to that.

Where we’re at

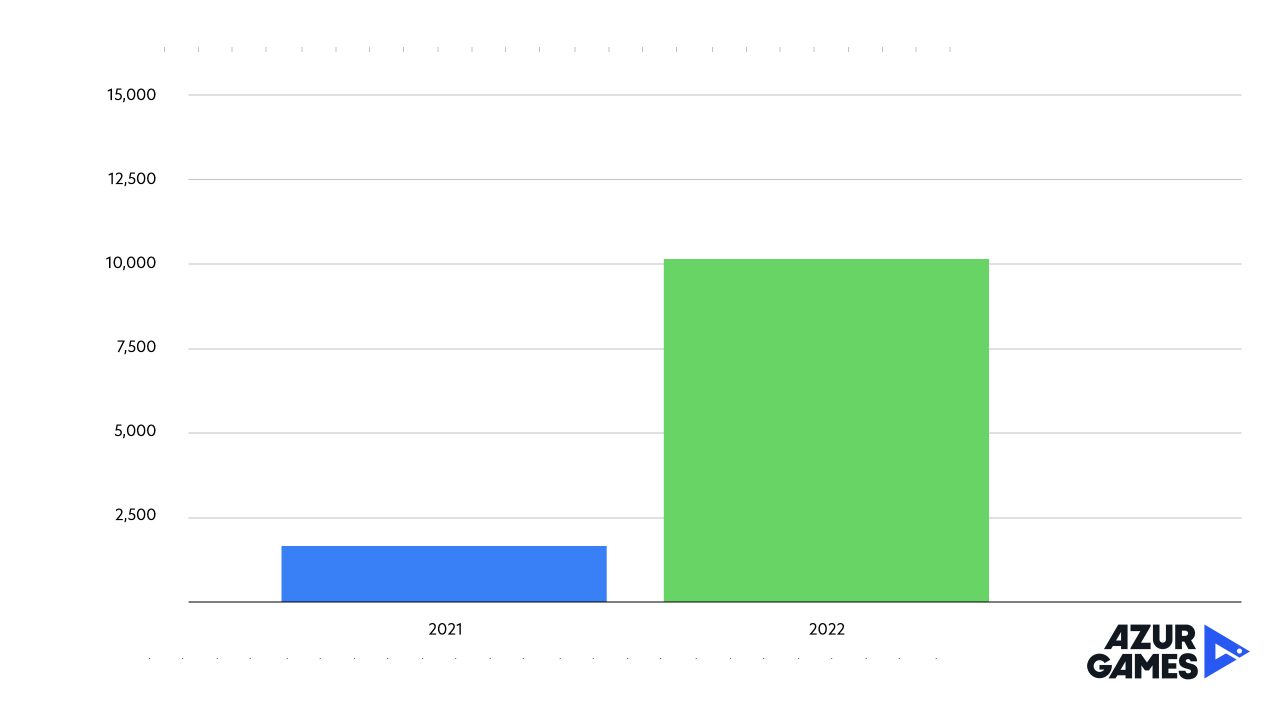

The total number of releases in 2022 compared to 2021 has increased by more than 5 times. The year is not over yet, so the gap will only widen.

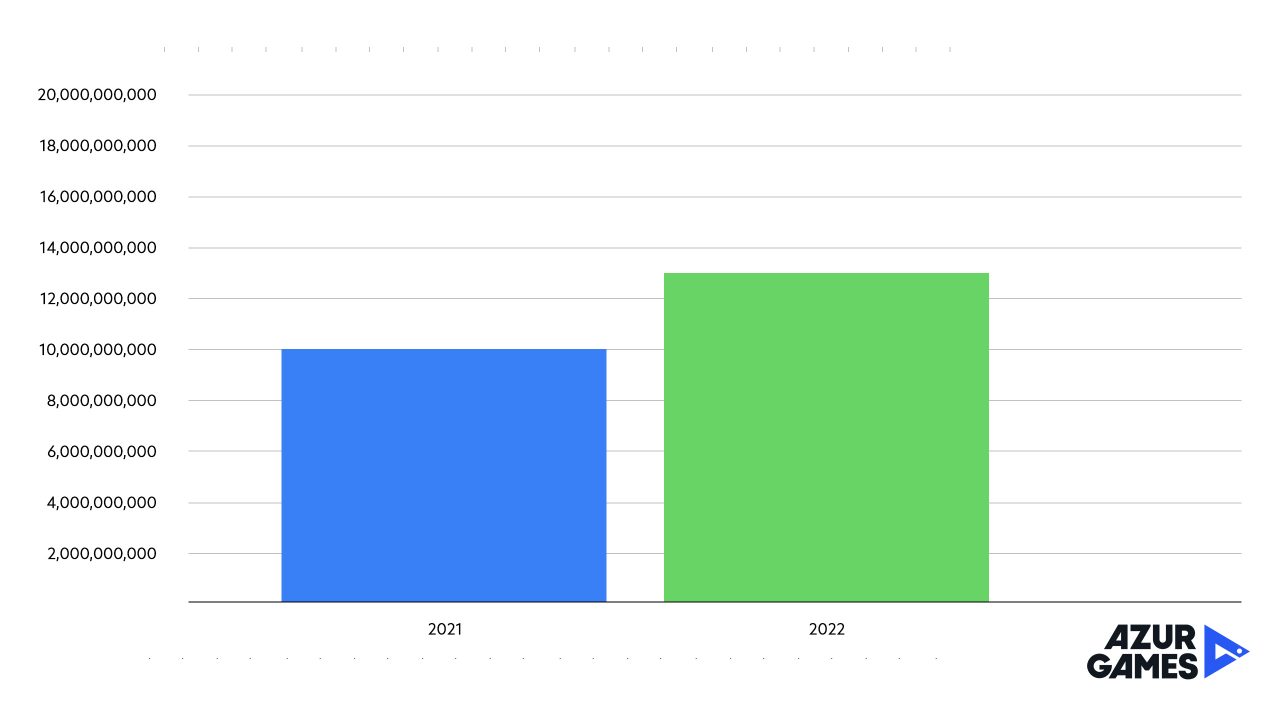

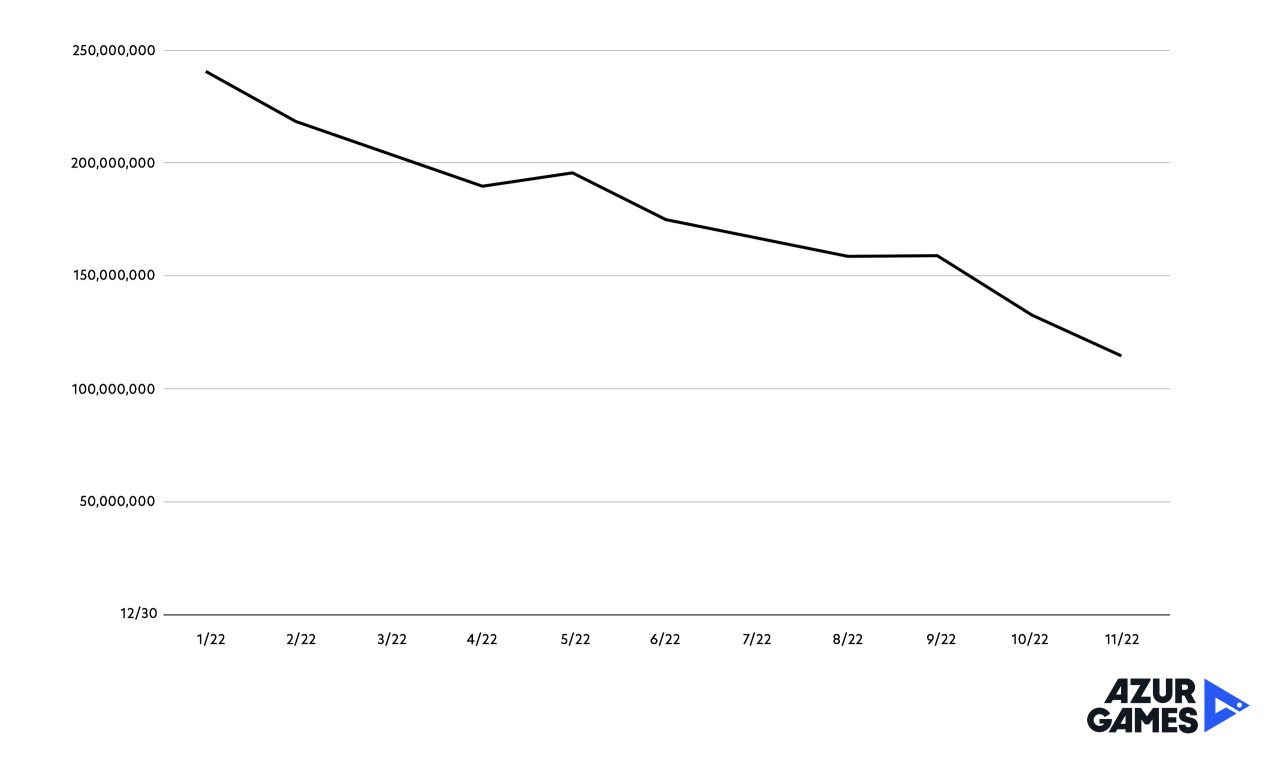

At the same time, the total number of installs hasn’t changed that dramatically:

This means that the growth of competition is far outpacing the growth of the hyper-casual market. Projects are lost among thousands of similar releases and it becomes more difficult to stand out from the crowd.

In this case, the quality of games comes first: from the general look&feel to very specific things that hyper-casual developers haven’t thought about before — high-quality assets, elaborate sound, effects, level design, meta, and so on.

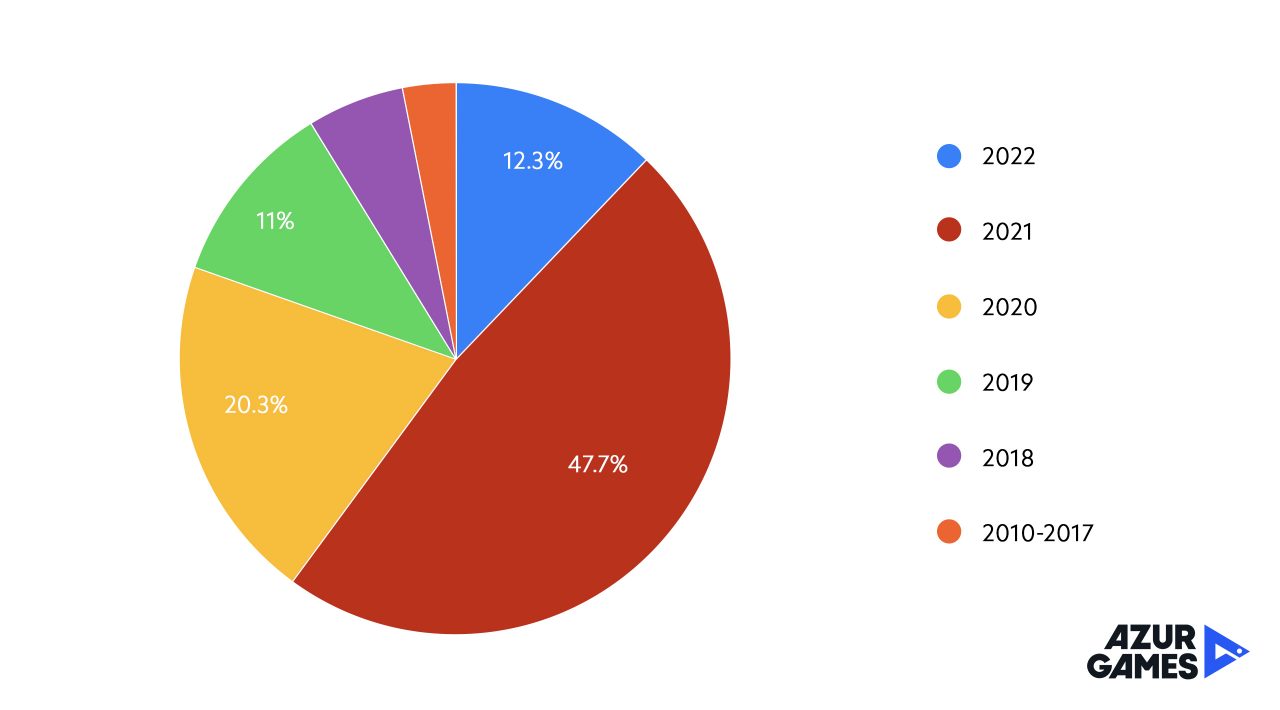

That being said, you have to compete not only with new releases, but also with projects that have kept the audience for years. Hit games released in previous years are in no hurry to leave the top 300 by installs in 2022. The share of games released this year is less than 15% of the top 300 (and Fruit Ninja has been there since 2010):

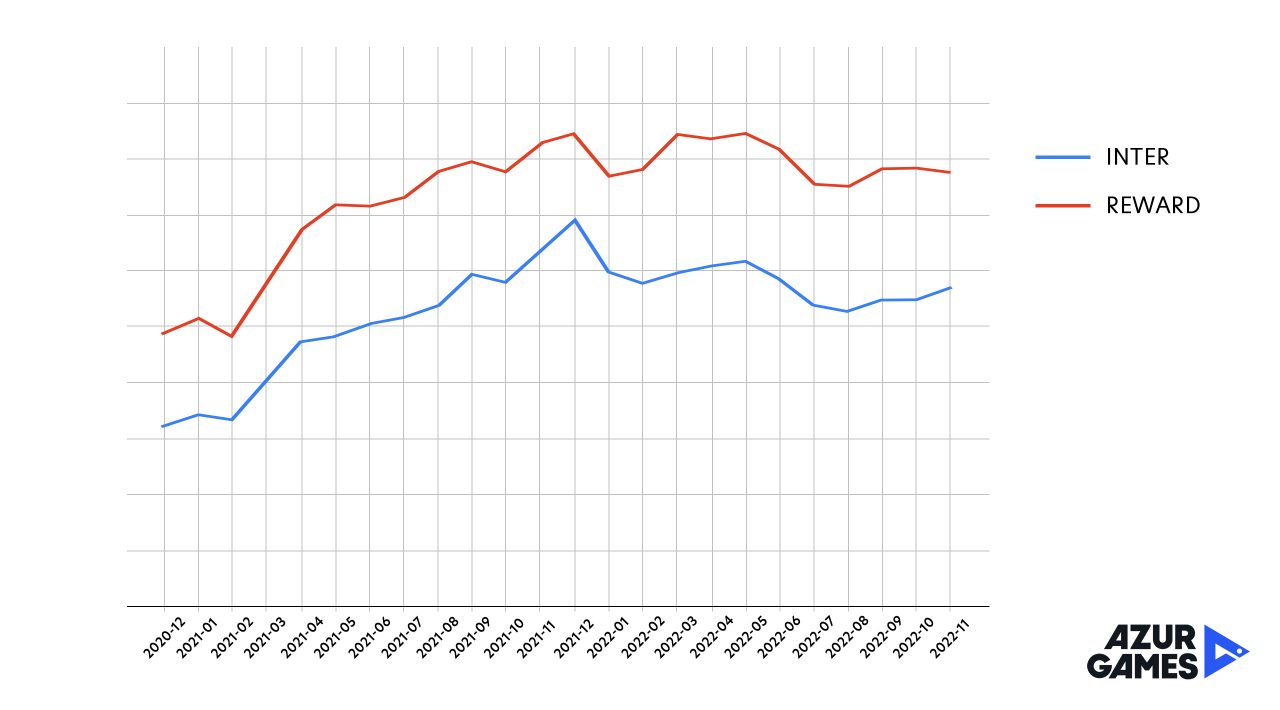

Against this backdrop, here is how our eCPM is performing in the US market after almost continuous growth throughout 2021:

Marketing campaigns don’t always pay off, and it forces the developers to adapt to a new market. Making 100 makeshift prototypes no longer guarantees success even in 1% of cases. Meanwhile, the development requires more and more resources — this applies to the size of teams, the required time, and to perfecting not only the core gameplay, but the meta as well.

It’s getting especially difficult for solo devs because the market is moving towards attracting investments or working with publishers that have more experience in the game. In order to increase the chances of releasing a successful product, you have to pay more attention to any ripples in the market.

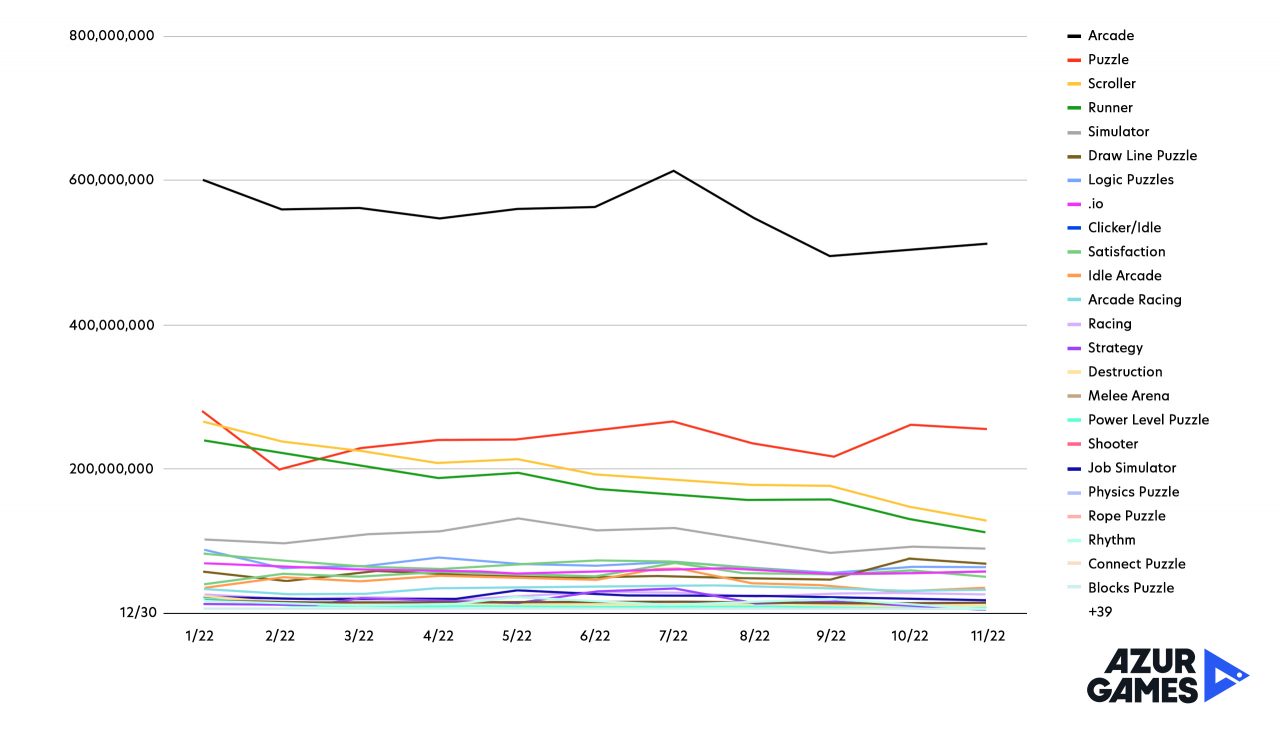

Installs by genre without reference to release dates

Let’s look at some graphs that show install dynamics by genre during 2022.

Disclaimer: Genreless releases were not taken into account. Also, an app can have several tags at the same time (for example, it can be listed as both an arcade and a racing game), so it can be included based on that.

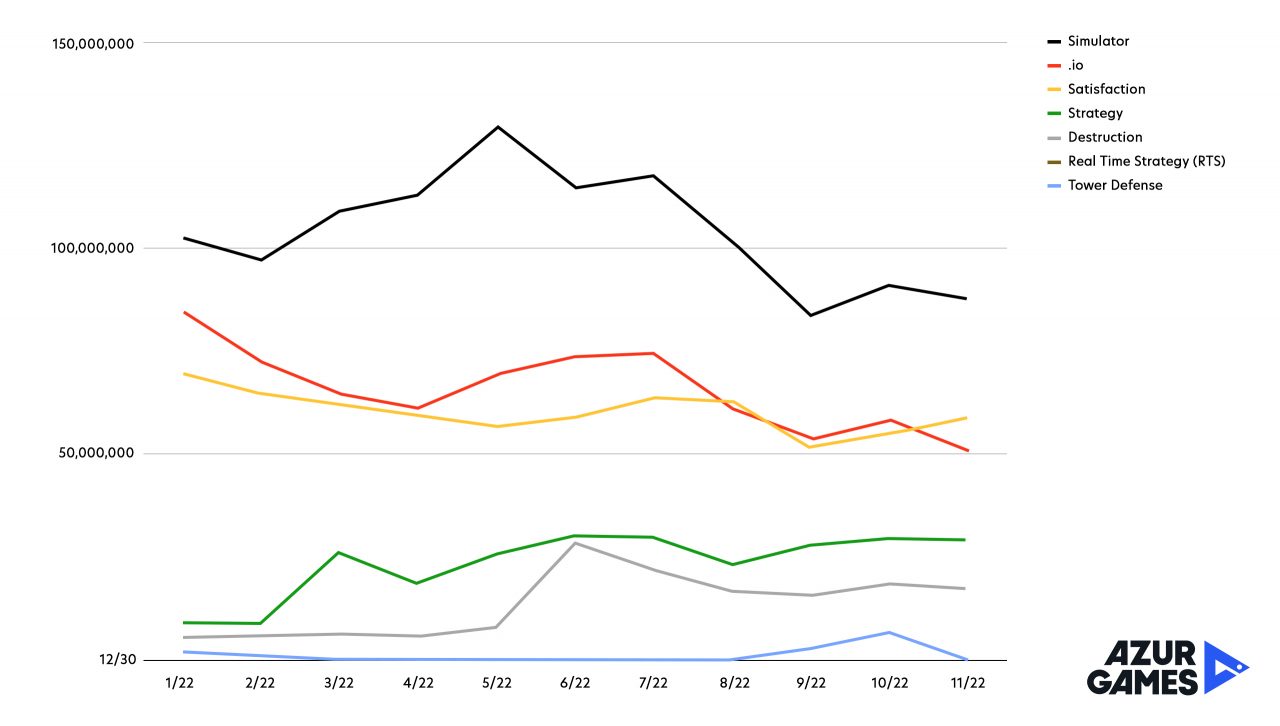

General picture:

Trends last at least two months in most cases. This applies to both growth and decline. Therefore, when one genre begins to grow, it can serve as a signal to get into the emerging trend as quickly as possible.

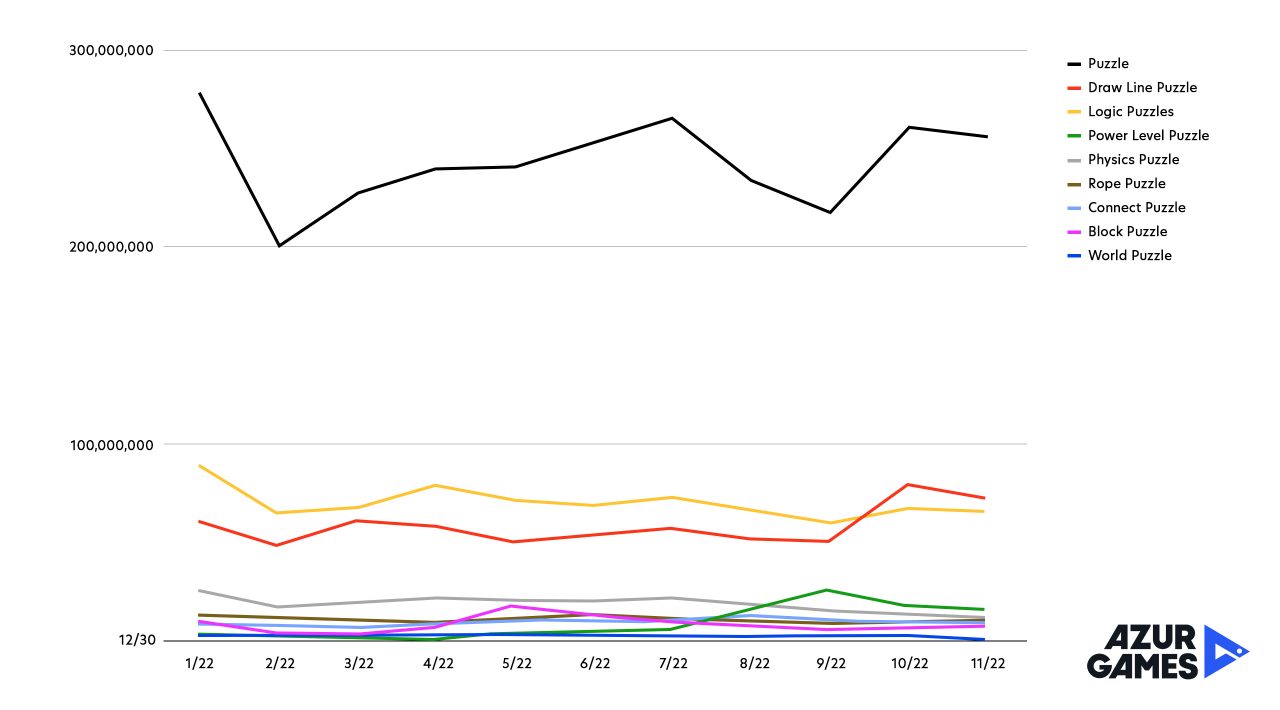

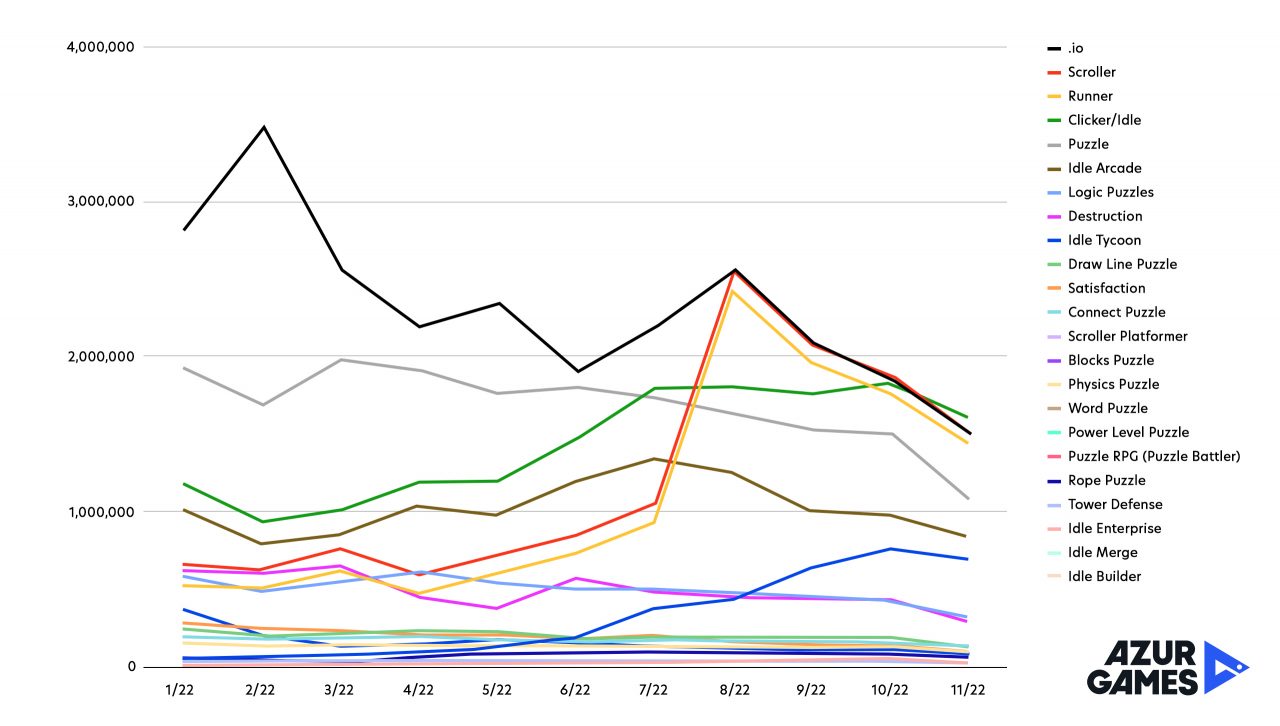

Since the beginning of fall, puzzles have been one of those trends.

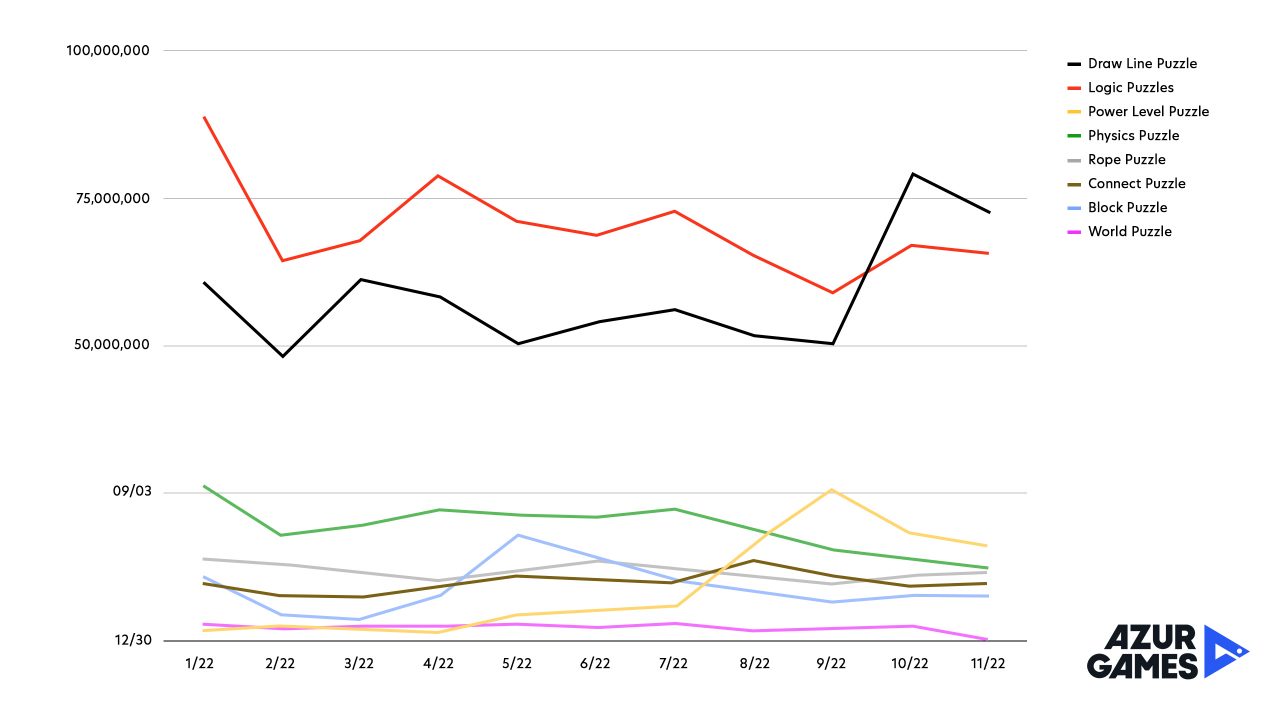

Let’s take a closer look at the subgenres, since the scale on the original graph is too large. After a two-month drop, you can see a sharp increase in installs, mainly due to the Draw Line Puzzle subgenre.

Logic puzzles have resumed growth as well, and we also see a possible consolidation of a new Power Level Puzzle subgenre (as in Save the Doge game, for example), which basically didn’t gain any installs until mid-summer.

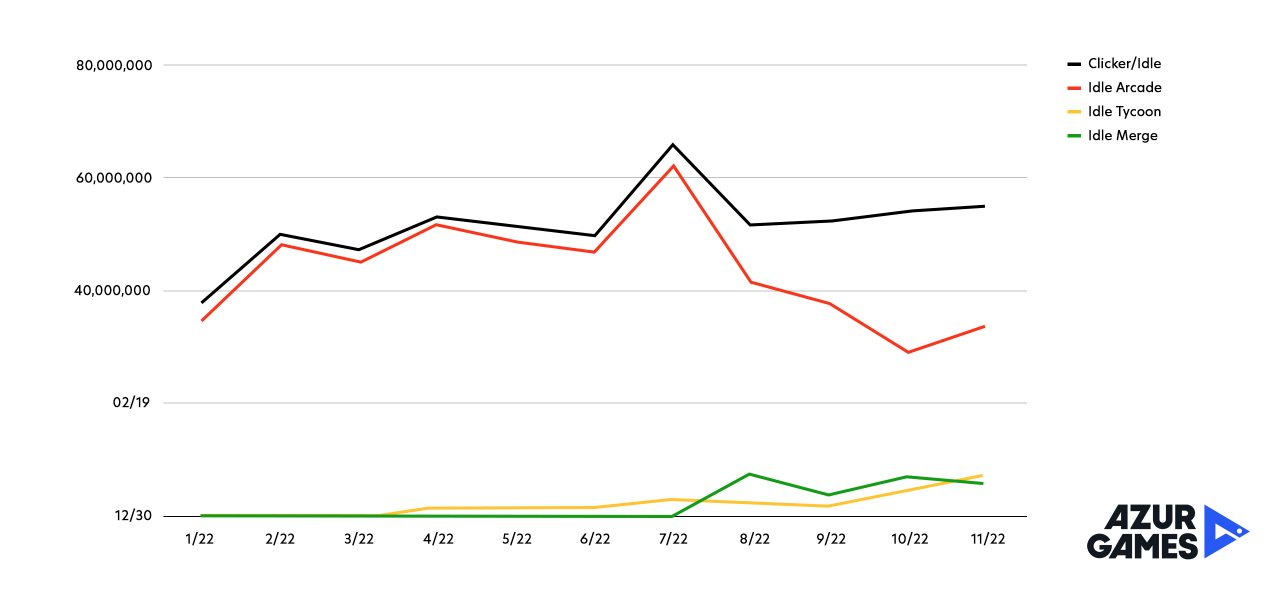

Now let’s look at the idlers. Their popularity has grown significantly over the past two years.

Compared to the beginning of the year, they show a good increase, with the exception of arcade games. But this is probably not caused by a drop in installs, but by a clearer positioning of genres and the division of Idle Arcade into several subgenres. We can safely say that Idle games are still trending and have good potential.

And then there are runner games — the once trendy genre is going through hard times in its history:

In absolute numbers, runner game installs are still high, which indicates a large number of fans of the genre, but the mass trend is going down and isn’t going to change any time soon.

Let’s look at other genres that are showing growth this fall.

After a serious drop, games in the Satisfaction and io genres began to show growth again. Maybe it’s a small upsurge, but games in this genre are still getting decent installs.

Strategy games perform consistently well: their popularity has tripled since the beginning of the year. After a sharp rise, the Destruction genre didn’t fall back to the numbers it had in the beginning of the year and even showed growth in early fall.

At the same time, the players’ desire to install Tower Defense has returned from being almost non-existent (we’ll find out which games it has to thank for this a little later):

In-app income dynamics for the aforementioned genres in the context of a year looks like this:

Despite the drop, io, scroller and runner games are generally at the top of the list. Idlers, on the other hand, are showing solid growth in in-app purchases (as well as in installs), which is a good sign for games in this genre that are going to come out in the near future.

Number of new releases by genre

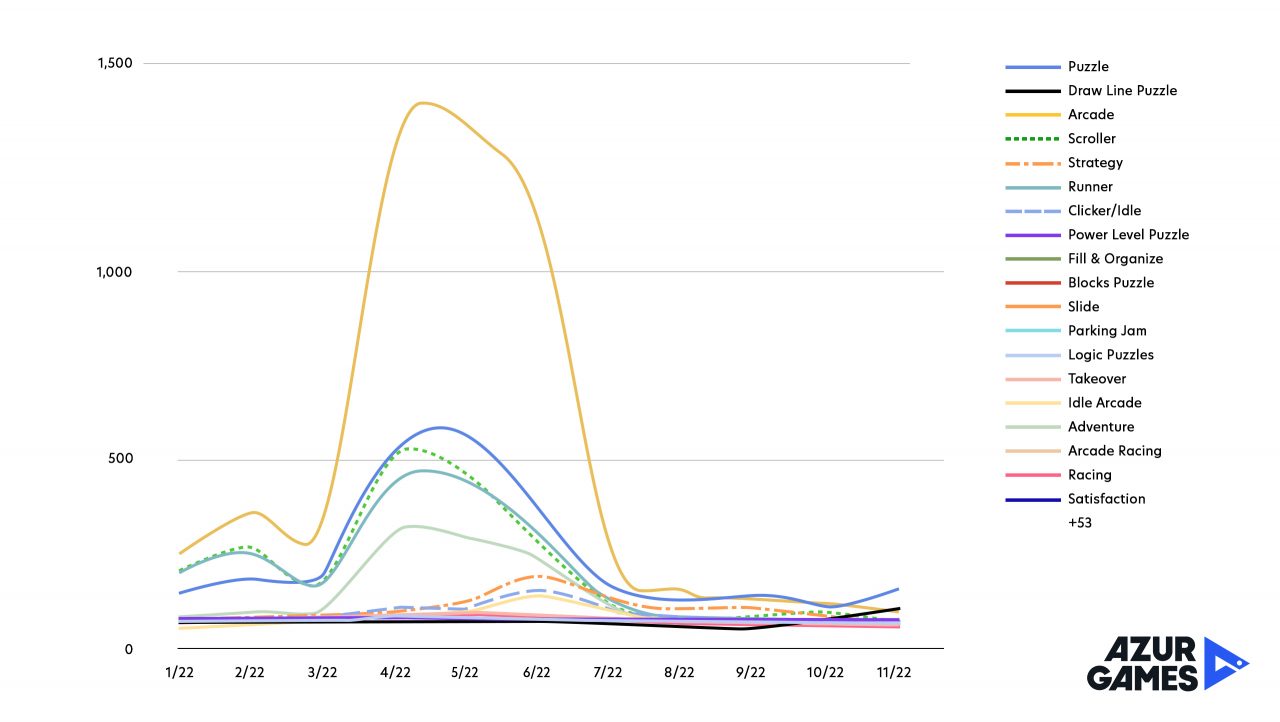

Now let’s see what genres of games the developers chose for their releases. Here’s the overall picture for the year (without the Arcade tag, which is present in a variety of genres):

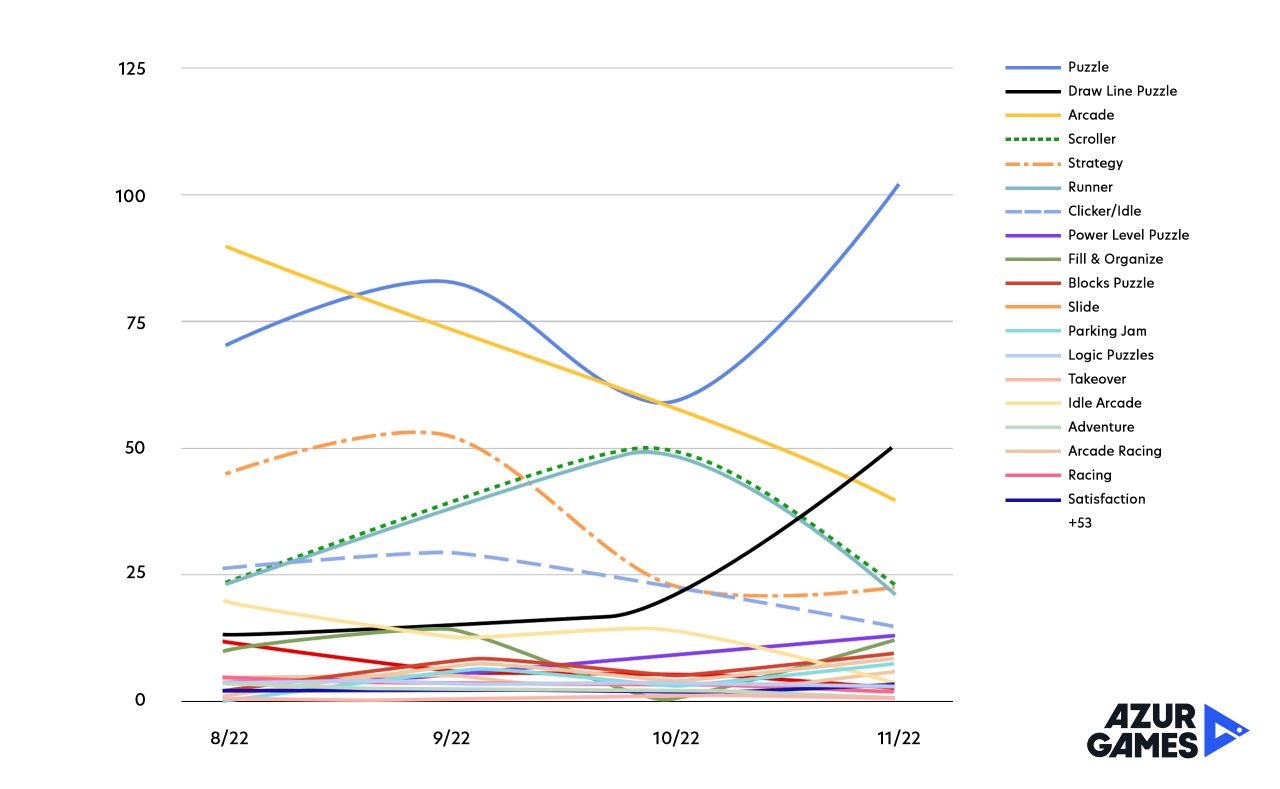

Let’s take the segment from August to November:

It’s evident that the developers really pin their hopes on puzzles, which are clearly trendy, with the new releases. They also rely on runners and scrollers, which still have a decent target audience, despite the fact that the global trend for them has passed.

This fall’s most popular projects and bestsellers

Let’s take the genres we mentioned and look at the top-grossing and downloaded titles from September 1st to the end of November.

IDLE

Top by installs (app | downloads):

- Lifting Hero | 16,400,000

- My Mini Mart | 14,000,000

- Eatventure | 10,200,000

- Office Fever | 8,400,000

- Button Fever | 8,200,000

- Marble ASMR | 7,300,000

- Mining Rush 3D: Idle Merge | 7,200,000

- Farm Land – Farming life game | 6,000,000

- My clone army: me, myself & I | 4,800,000

- Craftheim – Lumberjack Island | 4,800,000

Top by in-app revenue (app | revenue):

- Eatventure | $2,000,000

- My Little Universe | $1,200,000

- Build Master: Open Fire | $500,000

- My Mini Mart | $350,000

- Alien Invasion: RPG Idle Space | $325,000

- Junkyard Keeper | $112,000

- Farm Land – Farming life game | $83,000

- Sushi Bar Idle | $77,000

- Button Fever | $70,000

- Will it Crush? Idle Game | $63,000

PUZZLE

Top by installs:

- Stick Hero: Tower Defense | 30,200,000

- DOP 4: Draw One Part | 25,000,000

- Color Page ASMR | 22,600,000

- Thief Puzzle: to pass a level | 18,900,000

- Doge Rescue: Draw To Save | 17,300,000

- Brain Out: Can you pass it? | 15,700,000

- Lunch Box Ready | 15,000,000

- Save the puppy: Pet dog rescue | 15,000,000

- Parking Jam 3D | 14,800,000

- Brain Test: Tricky Puzzles | 14,800,000

Top by in-app revenue:

- Bricks Breaker Quest | $695,000

- Brain Test: Tricky Puzzles | $456,000

- Flow Free | $360,000

- Parking Jam 3D | $240,000

- Dig This! | $176,000

- Brain Test 2: Tricky Stories | $141,000

- Polysphere: Art Puzzle Game | $100,000

- Text or Die | $85,000

- Pull the Pin | $78,000

- Guess Their Answer | $76,000

RUNNER

Top by installs:

- Tall Man Run | 28,200,000

- Join Clash 3D | 14,400,000

- Count Masters: Stickman Games | 13,700,000

- Crowd Evolution! | 13,100,000

- Twerk Race 3D — Running Game | 12,400,000

- Shape-shifting | 12,400,000

- Coffee Stack | 12,300,000

- Steering Wheel Evolution | 11,100,000

- Gun Head Run | 10,600,000

- Ball Run 2048 | 9,400,000

Top by in-app revenue:

- Pocket Champs: 3D Racing Games | $4,100,000

- Miraculous Ladybug & Cat Noir | $330,000

- Crowd Evolution! | $198,000

- Count Masters: Stickman Games | $48,000

- Gun Head Run | $47,000

- Sky Roller: Rainbow Skating | $45,000

- Join Clash 3D | $35,000

- Tall Man Run | $32,000

- They Are Coming | $31,000

- Mutant Run | $27,000

SCROLLER

Top by installs:

- Tall Man Run | 28,200,000

- Join Clash 3D | 14,400,000

- Count Masters: Stickman Games | 13,700,000

- Crowd Evolution! | 13,100,000

- Twerk Race 3D — Running Game | 12,500,000

- Shape-shifting | 12,400,000

- Coffee Stack | 12,300,000

- Steering Wheel Evolution | 11,100,000

- Gun Head Run | 10,600,000

- Ball Run 2048 | 9,400,000

Top by in-app revenue:

- Pocket Champs: 3D Racing Games | $4,100,000

- Miraculous Ladybug & Cat Noir | $330,000

- Crowd Evolution! | $198,000

- Dancing Line – Music Game | $152,000

- Rolling Sky | $78,000

- Downhill Smash | $64,000

- Super Starfish | $51,000

- Count Masters: Stickman Games | $48,000

- Gun Head Run | $47,000

- Sky Roller: Rainbow Skating | $45,000

SATISFACTION

Top by installs:

- Dessert DIY | 19,300,000

- Phone Case DIY | 17,200,000

- Sculpt people | 13,100,000

- Hair Tattoo: Barber Shop Game | 11,800,000

- Foot Clinic – ASMR Feet Care | 8,200,000

- Ice Cream Inc. | 7,400,000

- Color Match | 7,200,000

- Acrylic Nails! | 6,000,000

- Hair Dye | 5,900,000

- DIY Makeup | 4,900,000

Top by in-app revenue:

- Ice Cream Inc. | $105,000

- Color Match | $46,000

- Cut and Paint | $35,000

- Woodturning | $24,000

- Squishy Magic: 3D Toy Coloring | $18,000

- Sneaker Art! | $17,000

- Jelly Dye | $16,000

- Acrylic Nails! | $15,000

- Spiro Art ASMR | $13,000

- Makeup Slime Fidget Trading | $12,000

IO

Top by installs:

- Snake Lite | 32,700,000

- Snake.io – Fun Snake.io Games | 16,200,000

- Worms Zone.io – Hungry Snake | 10,800,000

- aquapark.io | 10,600,000

- Fish Go.io – Be the fish king | 10,000,000

- Hole.io | 9,100,000

- Paper.io 2 | 8,700,000

- slither.io | 8,500,000

- Harvest.io – 3D Farming Arcade | 5,700,000

- War of Rafts: Crazy Sea Battle | 5,200,000

Top by in-app revenue:

- 球球大作战 | $3,500,000

- 贪吃蛇大作战-2017全新战队系统上线! | $447,000

- Hole.io | $299,000

- Agar.io | $273,000

- Snake Rivals – Fun Snake Game | $127,000

- Little Big Snake | $98,000

- ZombsRoyale.io | $93,000

- Snake.io – Fun Snake.io Games | $81,000

- King of Crabs | $65,000

- Worms Zone.io – Hungry Snake | $65,000

DESTRUCTION

Top by installs:

- Pixel Demolish | 7,600,000

- Kick the Buddy | 7,500,000

- Rope and Demolish | 5,500,000

- Falling Art Ragdoll Simulator | 5,400,000

- Bucket Crusher | 5,400,000

- Kick the Buddy: Forever | 3,800,000

- Hoard Master | 3,800,000

- Kick The Rainbow Friend | 3,200,000

- Fury Cars | 2,200,000

- Ragdoll Fall: Break the Bones! | 1,800,000

Top by in-app revenue:

- Kick the Buddy | $748,000

- Kick the Buddy: Forever | $227,000

- Hoard Master | $64,000

- Falling Art Ragdoll Simulator | $51,000

- Pixel Demolish | $47,000

- Despicable Bear – Top Games | $25,000

- Bucket Crusher | $25,000

- Rope and Demolish | $10,000

- Tower Crusher! | $7,000

- Demolition Car! | $6,000

TOWER DEFENCE

Top by installs:

- City Defense | 10,700,000

- Shoot Defense 3D (2022) | 985,000

- Shooting Towers: Merge Defense | 795,000

Top by in-app revenue:

- City Defense | $72,000

- Toy Army: Draw Defense | $1,500

Final thoughts

The expected market growth is going to be caused mainly by low-income regions, so a new surge similar to the one that occurred during the pandemic probably won’t come.

The current market is way less forgiving to mistakes, so major publishers are even more careful in choosing projects even at the niche stage.

It becomes less profitable for publishers to work with developers on the pay-per-prototype or burnout cover basis as the marketing effectiveness has dropped significantly. The studios that have good expertise and develop at a high level will be prioritized.

The popularity of hybrid genres will grow, as will the share of in-app purchases in monetization.