Developing a puzzle game after we decided to postpone it because of the metrics

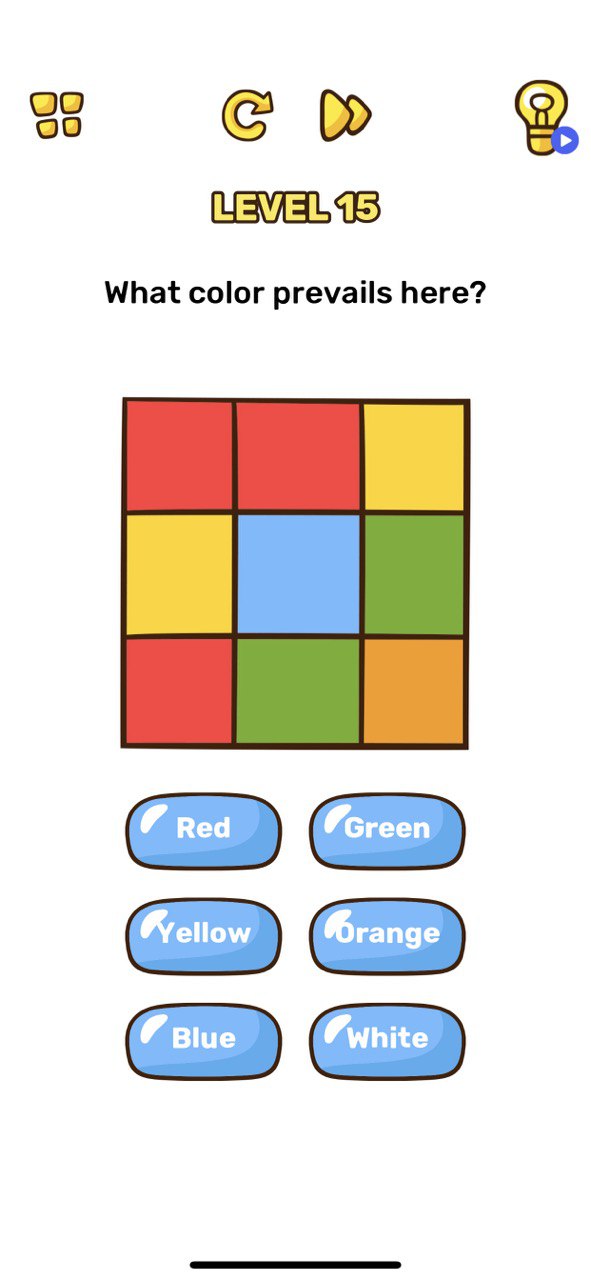

More than two years ago, the mobile market had very few puzzle games with unusual, sometimes even illogical outcomes. Back then, it was considered unique. For example, the player is shown several squares of different shades and, according to the task, they need to choose the lightest color in the picture. In order to get it right, you need to tap on the background of the screen because it’s white.

We decided to get into it no-holds-barred-style, without a crumble of experience in developing similar games. We even organized a massive contest with prizes within Azur Games for the most original puzzle. In many ways, we also went against the trends, but that only increased LTV.

In this article, we’ll talk about the development process, why we decided to abandon the game and how we brought Brain Blow back to life in a way that makes it earn money to this day.

Not your average puzzle game

The main feature of the game is that almost every objective has an unexpected outcome. The game has a good amount of humor to it, and a lot of levels that can’t be solved by standard logic.

That’s where we were faced with reality — the first tests showed that complex, too original puzzles have a bad effect on retention when we expected the opposite to happen. We thought objectives like that would make the players stay longer, but they turned out to be too hardcore for the audience.

We had to dilute them with a rather large percentage of ‘standard’ attentiveness tasks. Like ‘count the number of triangles in a figure’.

The first prototype took about a month to develop. The main goal was to understand whether we could attract users, so we made only 50 levels. The puzzles took the longest to come up with because there were so many original ones made from scratch.

We even launched a contest with prizes inside Azur Games to find the best or just the funniest puzzles. Actually, it was more like an event (with prizes) — the tasks were fun to come up with. As a result, almost all the tasks born out of the contest went into the game.

We conducted the first test — R1 was around 25%. But analytics showed that many people played through the whole game too quickly, so we focused on adding content, increasing the number of levels to 100.

We did another test, but nothing much changed.

And just like that, we shelved the project. We had more promising prototypes at that time, and it seemed like there was no point in wasting time.

The game’s comeback

After a couple of months, we noticed competitors coming into the scene. We took it as a sign and decided to take another look at our game’s performance.

First of all, we separated the retention by country. Previously, we looked at it as a whole and didn’t take into account the specifics of the game like textual puzzle descriptions and text hints that popped up if the player couldn’t find a solution. The problem laid on the surface: the test prototype wasn’t localized, everything was in English.

Naturally, it turned out that retention was good in English-speaking countries. It all happened a few years ago when we were a little less experienced, so we didn’t think about it right away. We measured the overall retention and the high metrics in the US were tainted by low retention in other countries that didn’t speak English.

We localized the game into 18 languages, and R1 grew up to 40%. We realized that we urgently need to launch, make content and develop the project. After that, we immediately began to acquire users, and we’re still doing this (and it’s been 2.5 years already).

The game’s earnings come in seasonally nowadays. In December 2021, the revenue was $200,000 with $60,000 profit, but now it’s lower.

There are about 550 levels now. We used to develop them actively, but at some point, we looked at the playthrough funnel and realized that it stopped really affecting the metrics any further.

At the same time, there are still some theories that we want to test for the game to keep growing. We tried to utilize the trends and made Squid Game and Huggy Wuggy levels in order to make ad creatives based on them and reduce CPI, but this didn’t bring a positive result.

It’s impossible to tell you about all the theories we tested, because we’ve been doing A/B tests every two weeks for two years now.

Other unique features

We’ve given up all in-game currency and keys. Usually in this genre, you use those to buy hints, and acquire currency and keys for watching in-app ads and doing daily quests. We made it work another way: the player clicks on the hint and immediately sees a rewarded ad. This simple update immediately gave the game a 25% increase in LTV.

We also removed daily rewards for entering the game and it didn’t affect the retention in any way, even though things like that are usually added precisely to increase it. Moreover, LTV increased even more because players stopped receiving free hints and immediately started watching rewarded ads.

Another thing we tested was different interface layouts and changed the location of the buttons for hint, skip, etc. Contrary to the trends, our version with the UI at the top of the screen always won. I think that these games don’t have a one-size-fits-all solution, and each project needs its own tests.

These little things are very interesting, because the audience overlaps a lot within the genre, but the players behave differently in every puzzle game.

We tried to simplify the puzzles. It increased playtime and retention, but negatively affected the LTV because the players stopped using hints. We made some levels that were too difficult, and the players left. In the end, we had to run about 40 tests to come up with a working level funnel that allowed us to move on to other things.

When it was all said and done, we finally allowed ourselves to think about animations, 3D, and cut scenes. We’ll probably save those thoughts for a new project, since hit puzzle games are still a thing, thankfully.