Market research: how to find a breakthrough ad creative. Part 1

Most mobile game developers and publishers struggle with ad creative “burnout” while promoting and scaling their projects. When players are repeatedly exposed to the same ad, their responsiveness dwindles, making it impossible to achieve marketing goals.

What if your current creative strategy fails, and your team is unable to find a breakthrough idea?

To discover growth opportunities, start by researching the market, your niche, and direct competitors to understand current trends and successful strategies. In this article, we’ll explore how we do it at Azur Games, complete with real-life examples and ad creatives.

Competitors

To achieve desirable results, analyzing your competitors is crucial and should be the first step of the process. This is where you can find the most valuable information.

Get a list of your direct competitors (which I hope you already have), and let’s get to business. We’ll do this by utilizing the practical example of the AppMagic service, but you can use any tool you like. Rather than discussing the currently prevailing trends, which can rapidly change and potentially mislead, I’ll focus on explaining the fundamental principles of operation, giving you the tools to conduct the analysis at any given time.

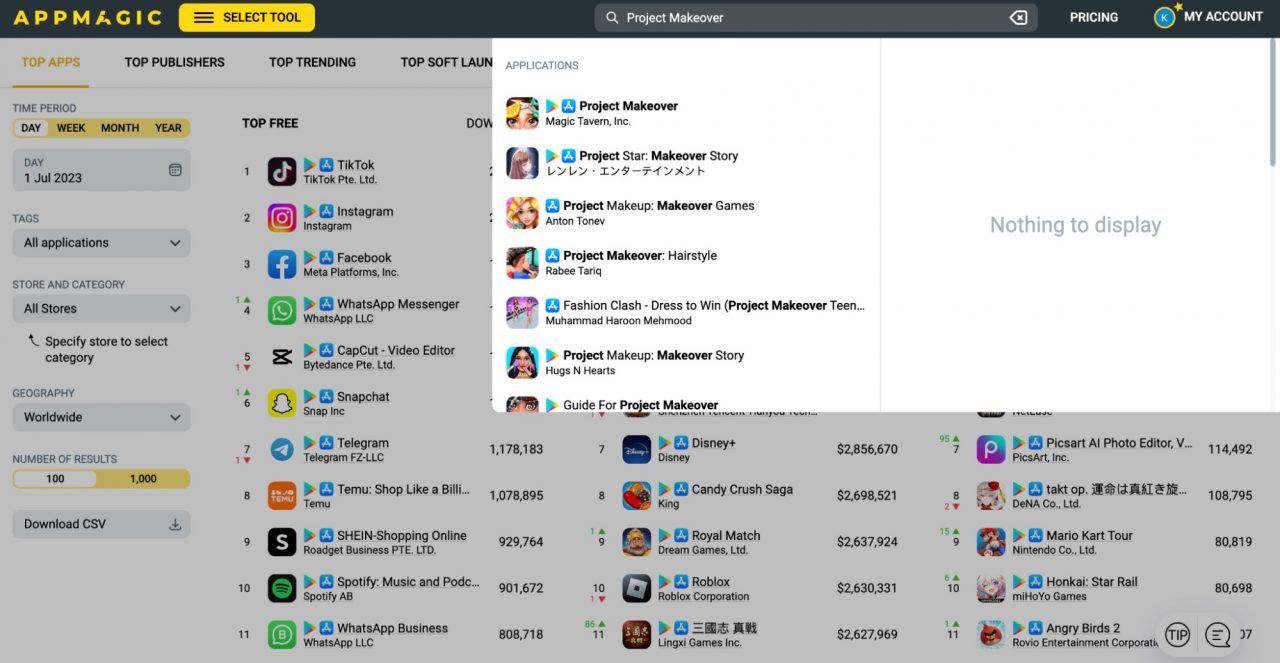

1. Open the service and enter the title you’re interested in.

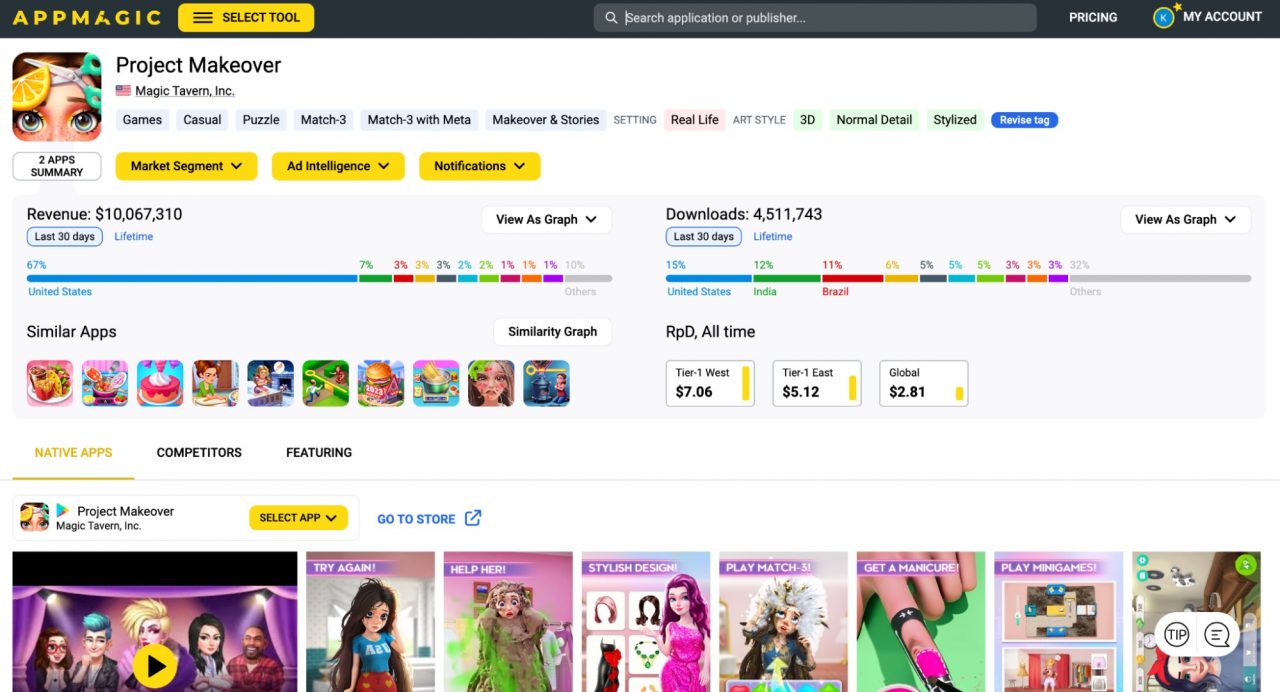

2. Click on the desired title to enter the section that contains all core information about it.

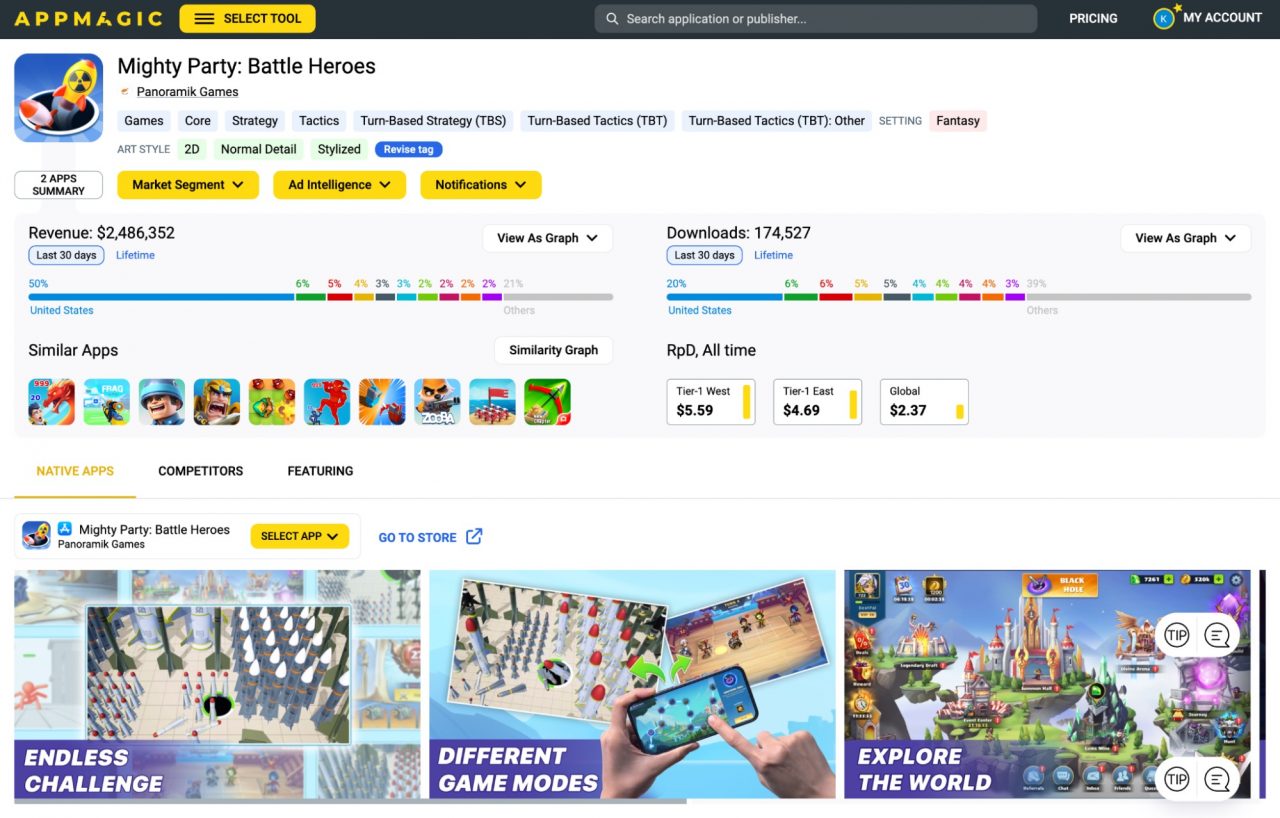

This section displays important metrics like the number of installs, income, top geographic regions, category, subgenre, store screenshots, competitors, art style, setting and more.

At this stage, store screenshots are especially critical because the top creative or links to it are often placed there to prevent a drop in click-through rate and IR, especially if the new top creative concept is misleading.

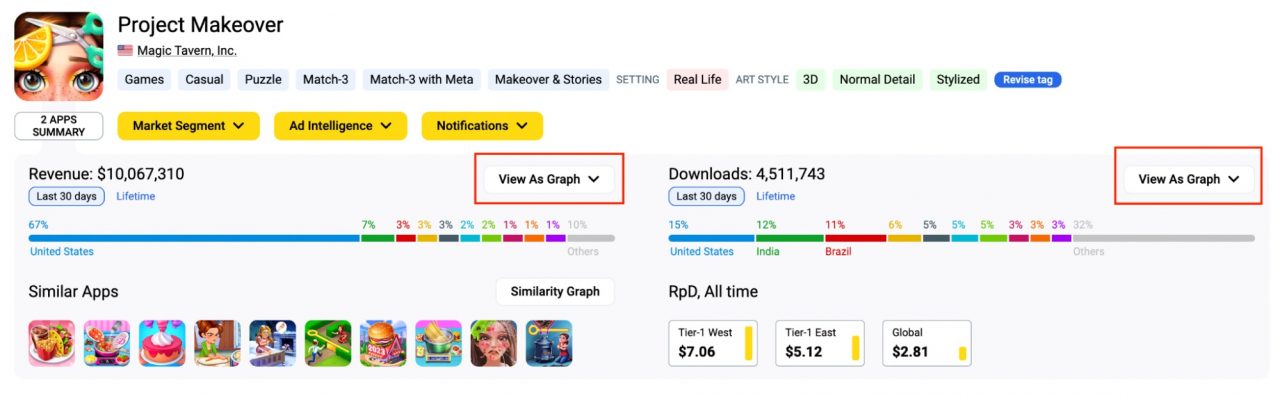

3. Next, let’s move on to the View as Graph section to review the Downloads and Revenue dynamics.

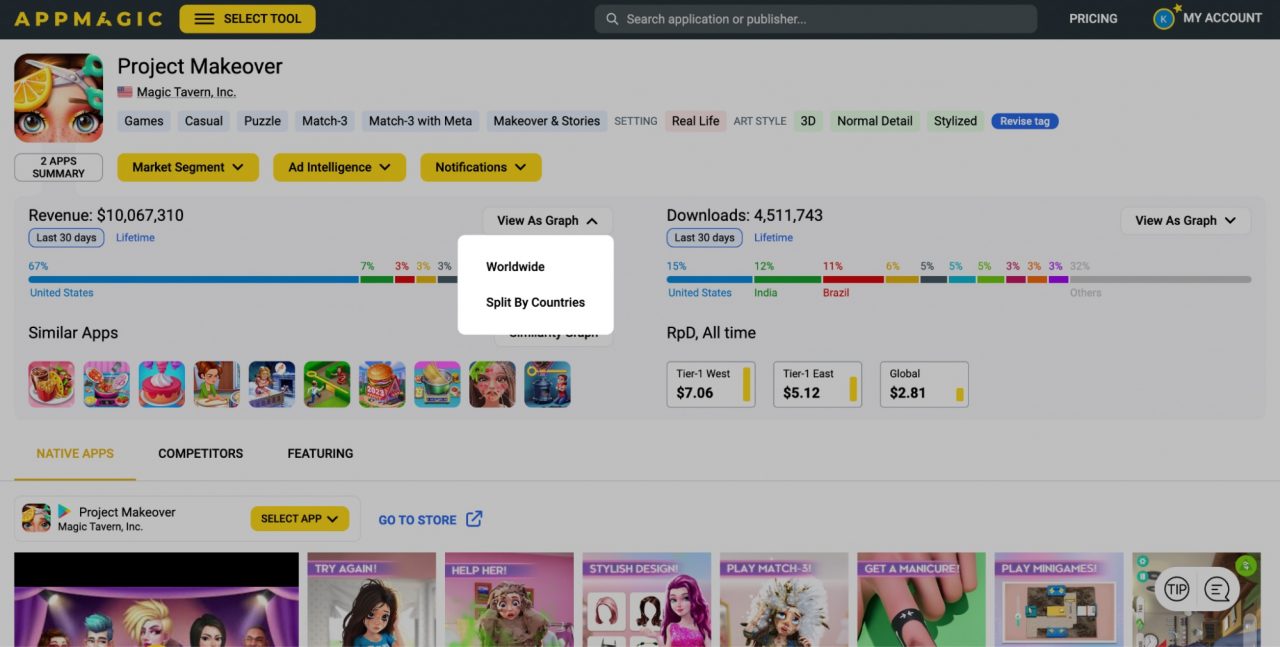

When selecting View as Graph, you have the option to choose WorldWide or Split by Countries. To see the distribution of spending or installs for each source, pick Split by Countries. To gain an overall perspective, choose WorldWide.

As we enter View as Graph, we can examine the growth patterns of our target game to determine its current stage of development. This information is crucial for our subsequent research because a sudden surge in growth is often due to a new creative concept that successfully boosted traffic.

To get the most out of our research, we can adjust the settings by selecting:

- Date range: It’s best to start with the last month’s data, but to get a comprehensive picture, I recommend extending the selection to the last 90 days.

- Geography: Although the US is a priority, it’s worth examining the top traffic sources from the Split by Countries section.

- Metrics: For most projects, growth in both downloads and revenue is important, except for hyper-casual games where downloads are the primary metric to consider, as most monetization comes from advertising.

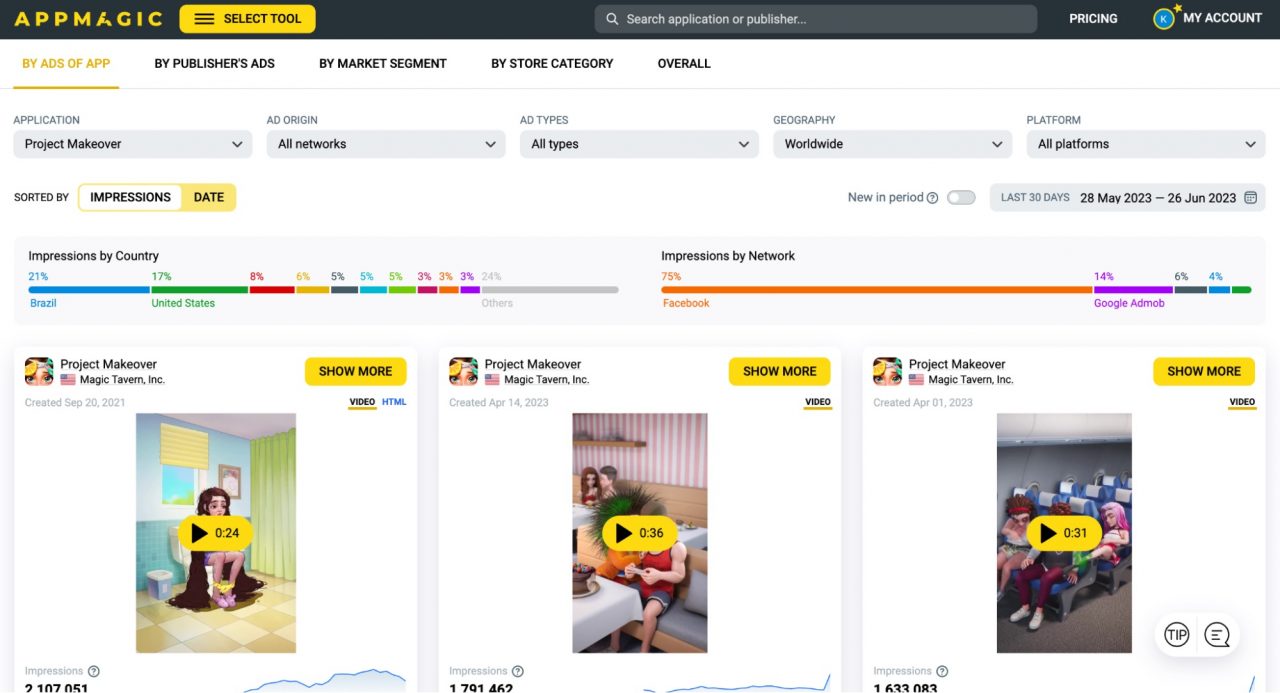

4. Go to the Ad Intelligence section, then click on the App Creatives subsection.

- Data Range. For regular research, viewing creatives from the last 30 days is optimal. To keep track of your competitors’ experiments, set the Date Range to the last two weeks.

- Geography. You can either select All Countries and US or your top geos to understand what kind of acquisition your direct competitors have there.

- Ad Origin. Look at all the sources that competitors acquire and select the ones that interest you. For instance, choose your top networks or networks where competitors scale.

- Ad Types. Usually, all types are relevant, but if you’re focused on studying Playable Ads, look at them separately.

- Platform. Here you can select either iOS or Android or both, depending on your research goals. Generally, I prefer to choose the All Platforms option unless I’m studying specific trends or acquisition behaviors on different operating systems.

- Sorted by Impressions/Date. Arrange the creatives by Impressions (starting with the most successful concepts and proceeding in a descending order) and by Date (starting with the most recently included creatives in the campaign). When I’m interested in viewing the most recent experiments and iterations of competitor creatives, I opt for sorting by Impressions and Date.

5. Analyze competitors’ creatives.

We examine competitors’ creatives not only by analyzing the AppMagic Top section, but also by additionally researching and paying close attention to the following successful creative indicators:

- Repetition or development of the same creative/concept in different interpretations. For example, Homescapes has been actively developing the concept of a puzzle with something that’s called pin mechanics, iterating on the same puzzle principle with varying circumstances the characters find themselves in.

- Another indicator of success is seen in improvements made to the same creative, such as adding an influencer in the corner of the video, a plate with text, and so on. These experiments are typically conducted on the top creative.

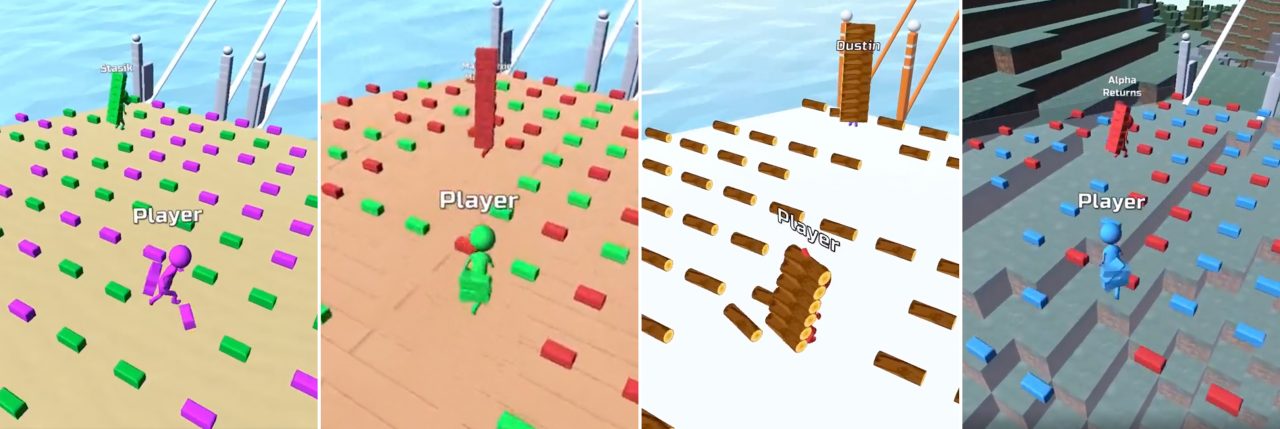

Bridge Race is a prime example of how the creative team tests one gameplay scenario with different environment elements and backgrounds.

- Playable ads repeat the concepts from the video creatives. Take a look at these video creative and playable ads below. It’s safe to say the concept is the same (besides that, there’s a fairly recent trend of stitching a playable ad to the end of the video):

- Keep an eye out for a new creative concept for the screenshots in the store. Mighty Party is an excellent example. This game purchases traffic directed towards top hyper-casual mechanics. Currently, the mechanic in focus is Attack Hole – Black Hole Games, a game from the French publisher Homa Games. Furthermore, whenever there’s a change to a new top creative concept, the entire ASO package (icon, screenshots, etc.) undergoes a change as well.

- Be sure to also pay attention to the dates when a competitor’s title experiences a sharp increase in downloads and revenue. You can view the creatives/concepts that were launched during this period, as they may have given the project a boost. Perhaps there was a change in the creative strategy or the team started acquisition for a new trend.

6. Compile a list of effective techniques, hypotheses, and creatives.

Don’t forget to include the ones that catch your personal interest. Sort everything into two categories:

- top performing techniques and concepts used by competitors;

- non-benchmark creatives that may not be at the top but could serve as a reference for future hypotheses. It’s crucial to prioritize the ideas and to avoid getting sidetracked by top concepts.

To rank the concepts of competitors, consider two primary variables:

- title revenue;

- how well the concept fits your title. Keep in mind that a top concept from one game genre may not be applicable to another genre (for instance, even the best midcore concepts are unlikely to be good fit for interactive stories). In the first instance, the primary target audience is women, while in the second, it’s men. Other influential factors include GEO, age, and the interests of the target audience.

And in the next part of the article we will talk about the market and global trends. Stay tuned!